As featured in Domain.

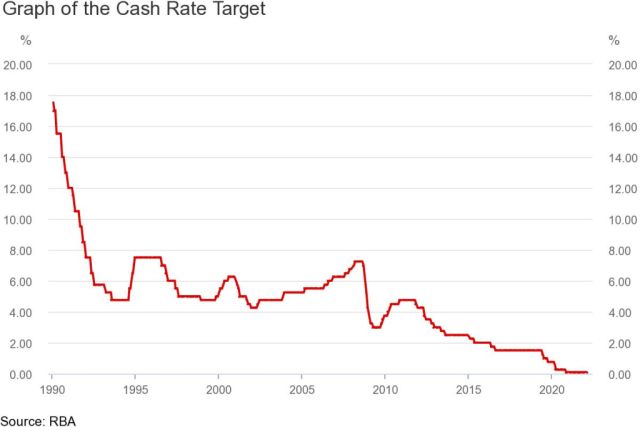

The official interest rate will remain at its record low of 0.1 per cent, where it’s sat since November 2020, the Reserve Bank decided at its March meeting on Tuesday.

Most economists, however, expect that it will start to rise later this year or early in 2023 in response to rising inflation, which is likely to be fuelled by the Russian invasion of Ukraine.

“It’s too soon to tell yet what the real effects of that might be,” said NAB chief economist Alan Oster. “That’s why the Reserve Bank is taking a cautious position of wait-and-see.

“The direct effects on Australia are likely to be pretty small and felt only through the price of oil and gas and wheat, which will all rise. It depends on how far they go up, and no one knows that.

“The Bank won’t be doing anything in the next three to six months and by then, hopefully, the situation will have settled down a bit and everything will be a bit clearer.”

The Reserve Bank board acknowledged that the Ukraine conflict has already pushed up prices of many commodities, highlighting continuing uncertainty around supply chains and global energy markets, but said it was too early to conclude that inflation is sustainably within the Bank’s target range of 2 to 3 per cent.

The RBA had forecast underlying inflation of around 3.25 per cent by mid-2022 and had indicated that it wanted to see substantial wages growth before it would support an interest rate rise.

The latest Consumer Price Index figures show it rose by 3.5 per cent over 2021, and is likely to continue its steady climb. That is set to be further affected by the Russian invasion of Ukraine, with both countries together producing nearly 30 per cent of the world’s wheat exports. Wheat prices have already jumped more than 5 per cent since the invasion.

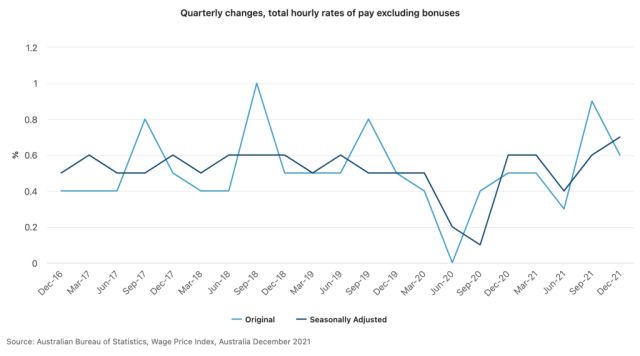

The Australian Wage Price Index, however, sits at 2.3 per cent for the year, which represents a fall in real wages of 1.2 per cent. At the Reserve Bank’s last meeting in February, members said they expected a pick-up in wages growth in response to the tightening of the labour market, but that there was still too much uncertainty around the response of labour costs to low levels of unemployment and the reopening of the international borders.

“The increase in prices isn’t about demand; it’s about supply chain issues,” Mr Oster said. “And wages are an issue. There’s been quite a soft 0.65 per cent rise in wages for the December quarter so we’re still waiting to see what will happen. Real wages are falling but with unemployment below 4 per cent, there may be more pressure on wages.

“So the Reserve Bank believe the economy needs support. I think any interest rate won’t be until August onwards but it will be tiny. By the end of the year, it could be 0.75 per cent and then it will keep going until it’s at 2 per cent.”

While the prospect of rate rises this year may strike fear into the hearts of many debt-laden households, the timing is still far from certain.

“So much of the current inflationary pressures appear to be transitory and supply-driven so even if the Bank decided to raise rates sooner rather than later, that wouldn’t do anything to cut inflation but it might risk harming the economic recovery,” said Sean Langcake, the head of macroeconomic forecasting at BIS Oxford Economics.

“They’ve been very clear that they will tolerate any over-shoot of inflation and are fine if it goes over the top of the range. But it’s about also looking at wage measures, and the wage figures look fairly uninspiring and it’s hard to see if the movement is in higher- or lower-paid jobs.”

“The hope is that low unemployment will drive up wages but there’s no precedent for having an unemployment rate close to 4 per cent before.”

Mr Langcake’s prediction is that rates won’t rise until the fourth quarter of this year and then, in line with the NAB forecast, it will involve small, incremental rises.

“I would be personally happy to see the market a little bit more subdued because it’s been incredibly challenging over the past two years,” he said. “We would inspect a lot of properties for clients, maybe 40 or 50 or 60, before we could come up with a shortlist of three or four or five that were worth buying. The rising prices meant a lot of secondary, or B-grade, properties were coming on.”

It also meant a lot of prospective buyers were missing out because competition was so fierce, but with interest rates slated to rise later this year or early next, that could change.

“Many potential buyers have been bitterly disappointed,” said Janne Sutcliffe of buyers’ agents Change of Address. “So now buyers can keep a close eye on the market and be prepared to take full advantage of the cooling conditions while good-quality properties are still available.”