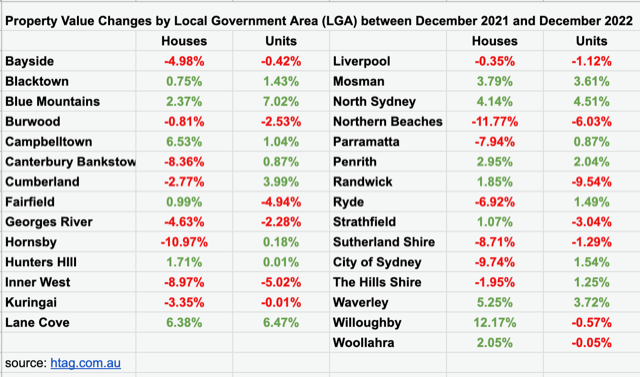

Here’s a table I’ve put together which compares property values for houses and units between December 2021 and December 2022 for Sydney Local Government Areas. (Source: HTAG.com.au)

You can see that prices were still higher in Dec 2022 than they were a year ago across a number of LGAs.

This somewhat informs my experience over the past few months in Sydneys East, Inner West and North shore suburbs.

In the LGAs where prices have held my negotiations have been more challenging as sellers held out for their number or withdrew the sale.

In areas where prices have pulled back (some Inner West pockets for example) there was more flex in the negotiation. However finding the property in the first instance was tougher.

Fewer quality properties came to market last year. And it was more challenging to secure quality off-markets as owners choose to defer a sale until the market rises again.

It was also a volatile time with interest rate announcements and other negative news creating momentary windows of opportunity and frequent fluctuations in price and sentiment.

What about demand?

There were certainly less buyers actively searching in 2022, although buyer activity has picked up in Jan.

Many of my buyers also revised their purchase price targets. Sometimes because loan serviceability had changed but in many instances it was a voluntarily choice for a more modest level of debt.

There has also been a dose of realism as buyers still demanded quality but were perhaps content to consider an alternative suburb or make concessions on land size, number of bedrooms, or proximity to school or transport.

It’s early days for 2023 but I’m still seeing resilience across many suburbs. That may change as 1.27M households roll onto higher variable rates but consider a third of Australia’s 9.8M household owners have no mortgage which means only 19% of mortgage holders will be affected.

Are we near a market bottom? The table above says much about how different areas are performing. Yes, perhaps some suburbs have bottomed whilst perhaps others have further to fall. Perhaps the gap between units and houses will close. Perhaps government incentives will create bubbles at certain price points. Sydney is many markets, each responding to their own set of market forces.

I expect a continued period where more due diligence than ever is required to not only ensure the property stacks up, but to have an up to the minute read on local sentiment as well as intel on seller motivation to deploy the strongest lines of negotiation. I found in late 2018 and again in mid 2020 the best deals came by being prepared at a time when sentiment was negative and competition was low and that’s what it feels like now.

Want to chat more? Send me a message or you can book a call with me here.